How Much Money Can You Make With Bitconnect

In a menacing turn of events yesterday, Bitcoin investment lending platform BitConnect abruptly announced it is shutting down its lending and exchange services. But while this sudden "curveball" might have come up equally a massive surprise for thousands of gullible investors, the writing was on the wall all along.

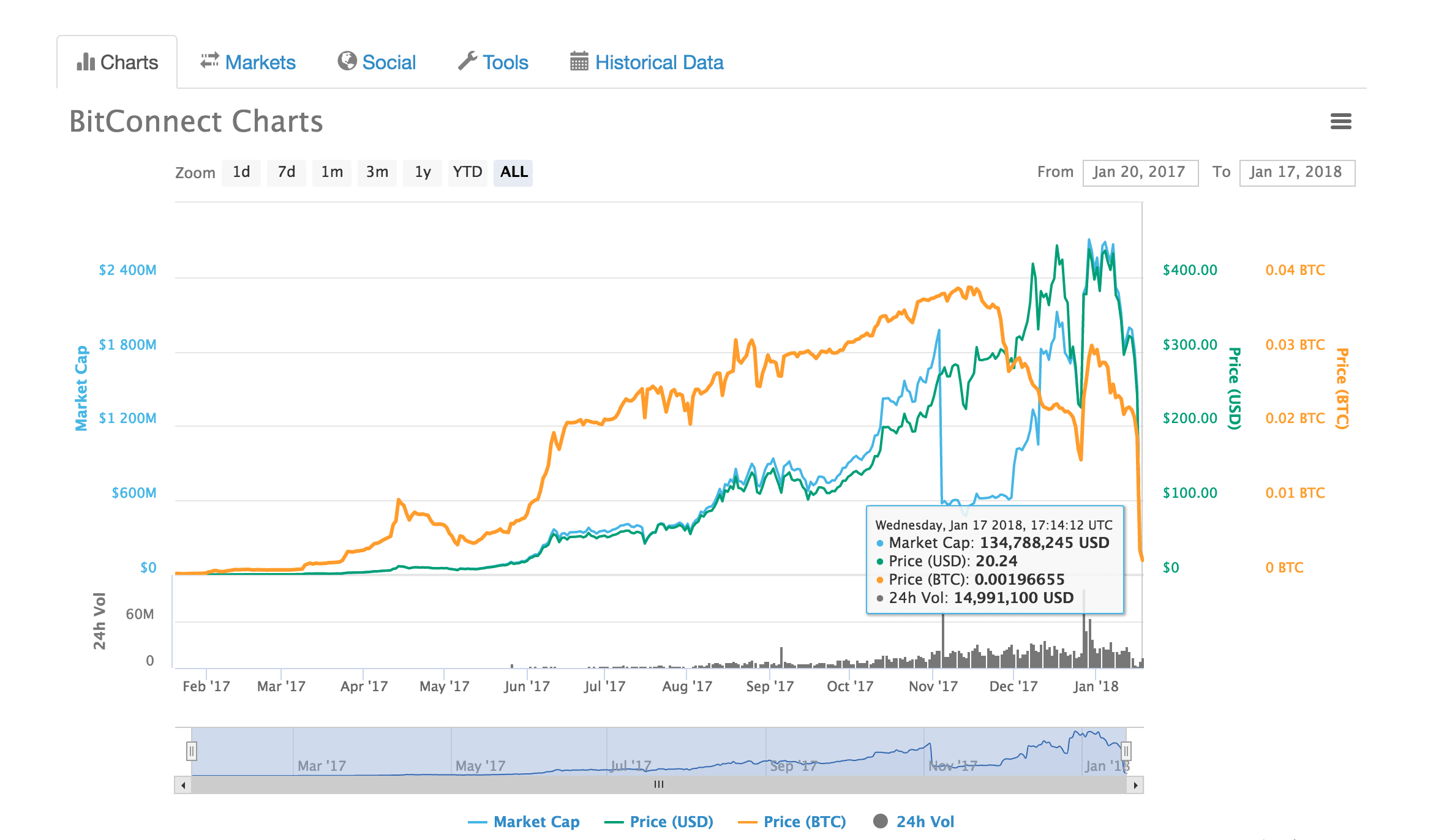

The visitor, which made its foray into the cryptocurrency scene with an initial coin offering (ICO) in late December 2016, swiftly cemented its position as one of 2017's best performing currencies on CoinMarketCap. Indeed, during its heyday, BitConnect boasted a market cap of over $2.vi billion and a value exceeding the $400 mark.

But despite its meteoric growth and burgeoning user base of operations, the investment platform attracted a swarm of naysayers with its suspicious business model, which vocal critics repeatedly labeled a Ponzi scheme.

Guaranteed to earn investors upward to xl per centum full return per calendar month, BitConnect followed a four-tier investment arrangement based on the sum of initial deposit – the more cash you put down, the bigger and faster profits you could rake in.

Regardless of the stake though, investors were promised a one-percent return of investment (ROI) on a daily basis. To this end, the company had developed its own proprietary "trading bot and volatility software" that would turn your Bitcoin investment into a fortune. Or then the information provided on the website suggested.

This meant that salting $1,000 away into your BitConnect investment business relationship could net you lot more than $50 one thousand thousand within three years, assuming the scheme does indeed live upwards to its promise for one-per centum interest compounded on a daily ground. Needless to say though, many deemed this model unsustainable.

Among the kickoff ones to vocalization his concern with the visitor was Ethereum founder Vitalik Buterin. "If [one percent per twenty-four hours] is what they offer," he said on Twitter back in November, "then that's a [P]onzi [scheme]."

Despite these warnings, BitConnect continued to choice up momentum.

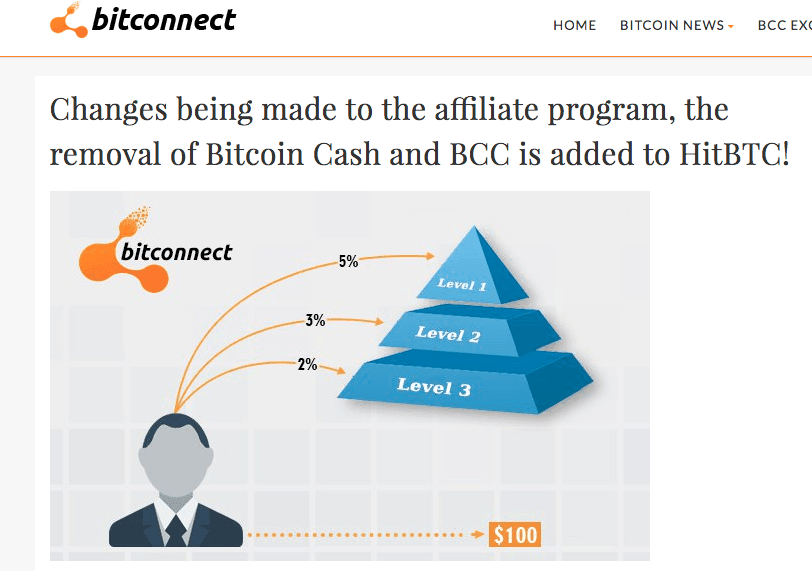

Indeed, the visitor relied on an aggressive marketing strategy on all fronts. Putting aside its all-encompassing digital and issue marketing efforts, the company had enlisted a big regular army of multi-level chapter marketers to recruit new investors, who could then work their way upwardly by bringing in even more new investors – and so on and so on. In the real world, nosotros telephone call this a pyramid scheme.

Other than "educating" prospective investors nigh BitConnect, the sketchy marketers engaged in copious amounts of blatant shilling for the dodgy investment platform and its BCC money.

The tactic, which the promoters employed beyond multiple channels and social media platforms, essentially involved ballyhooing the Bitcoin investment service past touting screenshots of the impressive "profits" BitConnect has brought them; that is despite the fact that most of their winnings came from affiliates – not investing.

Still, BitConnect was thriving with this disingenuous approach, attracting hordes of naive backers willing to put downwardly their money. Indeed, the ingenuity of this method became most apparent when the platform began facing its first legal troubles.

Every bit one of the 20 biggest cryptocurrencies by marketshare, by that time the bullish investment service had expanded plenty to attract the attending of the authorities. Following an investigation in November, the British Registrar of Companies served BitConnect with a strike-off notice, threatening to close it down and dissolve its operation unless farther activity is taken.

"Upon dissolution all property and rights vested in, or held in trust for, the company are deemed to exist bona vacantia, and appropriately volition belong to the crown," the filings read.

Within a week, the news had reached mainstream media, with numerous outlets reporting on the affair and thousands of spooked investors speculating about the implications on Reddit. This is when the promoter emergency task force stormed in, spewing all sorts of mindless crap to dispel this "imitation news."

In fact, TNW was the star of 1 of these videos, created by a promoter better known as Ryan Hildreth. Hildreth has since wiped the video from his ain YouTube channel, only someone was thoughtful enough to salvage and re-upload information technology. (Update: the video has since been deleted again)

Downplaying the legal threats, the promoters stuck to the script and continued to shill BitConnect. Instead, they suggested that the strike-off notice affected only a express segmentation of the visitor (BITCONNECT LTD), and thus would conduct no repercussions for its main registration (BITCONNECT INTERNATIONAL PLC).

Following a closer look at the multiple instances under which the visitor was listed on the British Companies House website, it became articulate that BitConnect had concealed – and mayhap lied about – numerous textile facts about its operation, including its location and the identity of its founding members.

Unfortunately, none of these warning signals seemed to have instilled a sense of doubt in the minds of the numerous investors. In the concurrently, BitConnect was tirelessly working on upscaling its reputation and building upward its make worldwide to distract naive backers from the real troubles information technology was facing.

The visitor had signed a partnership with Blockchain Expo where it had its own stand in California, it attended the ICO Result briefing in Amsterdam as a sponsor, and even hosted its own gaudy arrange-and-gown gala dark in Thailand. In fact, the last venue was where the notorious BitConnect meme was built-in.

Things would soon begin taking a turn for the worst though.

Less than two weeks ago, BitConnect got slapped with a cease and desist letter from the Texas Securities Board, ordering the company to close down its functioning and cut distribution of BCC – at least until it had worked out an understanding with the Securities Commissioner or was granted the necessary exemptions to continue its concern.

The notice from the Texas Securities lath was followed past yet some other cease and desist letter a calendar week after – this time around from the North Carolina Securities Division.

Both filings insisted BitConnect was running a potentially fraudulent performance, implicating the visitor in a series of violations. Interestingly though, the N Carolina notice also suggested that the BitConnect promoters – who had accumulated thousands of dollars in profits – were also breaking the law.

Soon later on this news, the in one case-devoted promoters began distancing themselves from the platform, claiming they never endorsed it in the first place. Some of them went on to purge their unabridged YouTube channels, while others simply moved on to shilling other cryptocurrencies.

In the meantime, BitConnect had come up upwards with a artistic approach to distracting users away from the litany of "bad press" it was bombarded with.

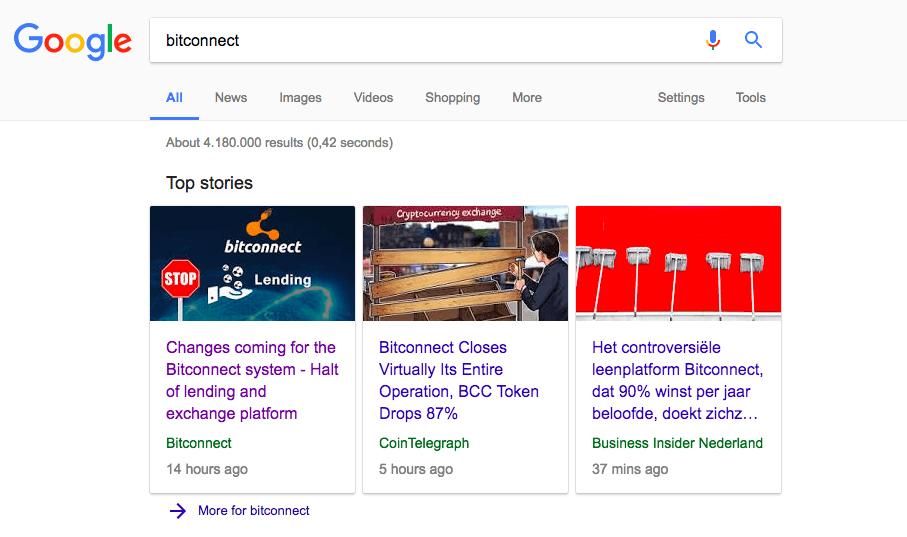

The company had launched its own news segment – perhaps every bit a strategy to raise its SEO profile. But its content output was steady enough for Google to list the platform as a "legitimate" news source, displaying information technology in the dedicated news carousel on Search – side past side other credible medias.

This might seem like a harmless piffling alter, but the result was thoroughly sinister.

At present that BitConnect had a regular stream of content, anyone Googling the company would be met with news bits produced past BitConnect itself. What was particularly problematic is that legitimate news pieces were now slumped nether a pile of meaningless content.

Just similar this, BitConnect had constitute a fashion to sweep all negative coverage under the carpeting past simply churning out more than content – as far every bit Google search went at least.

Information technology was simply yesterday when BitConnect's shenanigans were finally starting to catch upwardly with them.

Following a streak of server downtime, the company revealed that it was shutting down its lending and exchange platform. Above annihilation else, it attributed its fall to "bad press." Though information technology did admit that legal troubles and continuous DDoS attacks had also played a office in this decision.

"We are closing the lending operation immediately with the release of all outstanding loans," the statement read. "With release of your entire agile loan in the lending wallet we are transferring all your lending wallet residuum to your BitConnect wallet balance at 363.62 USD [sic]."

"In short," it continued, "we are closing lending service and exchange service while BitConnect.co website will operate for wallet service, news and educational purposes."

In the aftermath of the announcement, BCC collapsed almost in an instant, plunging all the way down to under $30 – a monstrous 96-per centum subtract in value.

Immediately later the ominous declaration began spreading across the net, hives of freaked out investors flocked to the BitConnect subreddit (which has since been locked downwards). The segment was flush with panicked posts.

"This cant be information technology. I lost everything. EVERYTHING," one thread read. Some other i – titled "800-273-8255 is the Suicide Hotline. Money Isn't everything. Your life all the same matters after all of this" – encouraged distraught investors to stay calm and non do annihilation drastic. This is how deep the touch of BitConnect'south fraudulent operation is.

If that hadn't get credible by now, BitConnect was extremely popular across the board.

To give you a better perspective on the magnitude of damage BitConnect's shifty business has caused to its thousands of investors, its site has been translated to several different languages – including Vietnamese, South Korean, Indian, Indonesian, Japanese, Thai, Cambodian and Filipino.

So why is information technology important to document the trickeries BitConnect resorted to? Considering the signs were always there.

While the Bitcoin investment platform is practically defunct now, it has inspired a slew of copycats – including EthConnect (based on Ethereum), XRPConnect (based on Ripple), and NEOConnect (based on NEO). It is as well important to remember that its BitConnect X ICO continues to be active.

Ignoring the fraudulent tactics that made BitConnect the behemoth that it was is tantamount to risking falling victim to the aforementioned scheme again – and we should do our best to avert such traps.

So instead of writing it off, BitConnect must live on as a cautionary tale to every cryptocurrency rookie placing all of their eggs in a bottomless basket. You know what they say: All that glitters is not gold.

Source: https://thenextweb.com/news/bitconnect-bitcoin-scam-cryptocurrency

Posted by: mcquadefrouss.blogspot.com

0 Response to "How Much Money Can You Make With Bitconnect"

Post a Comment